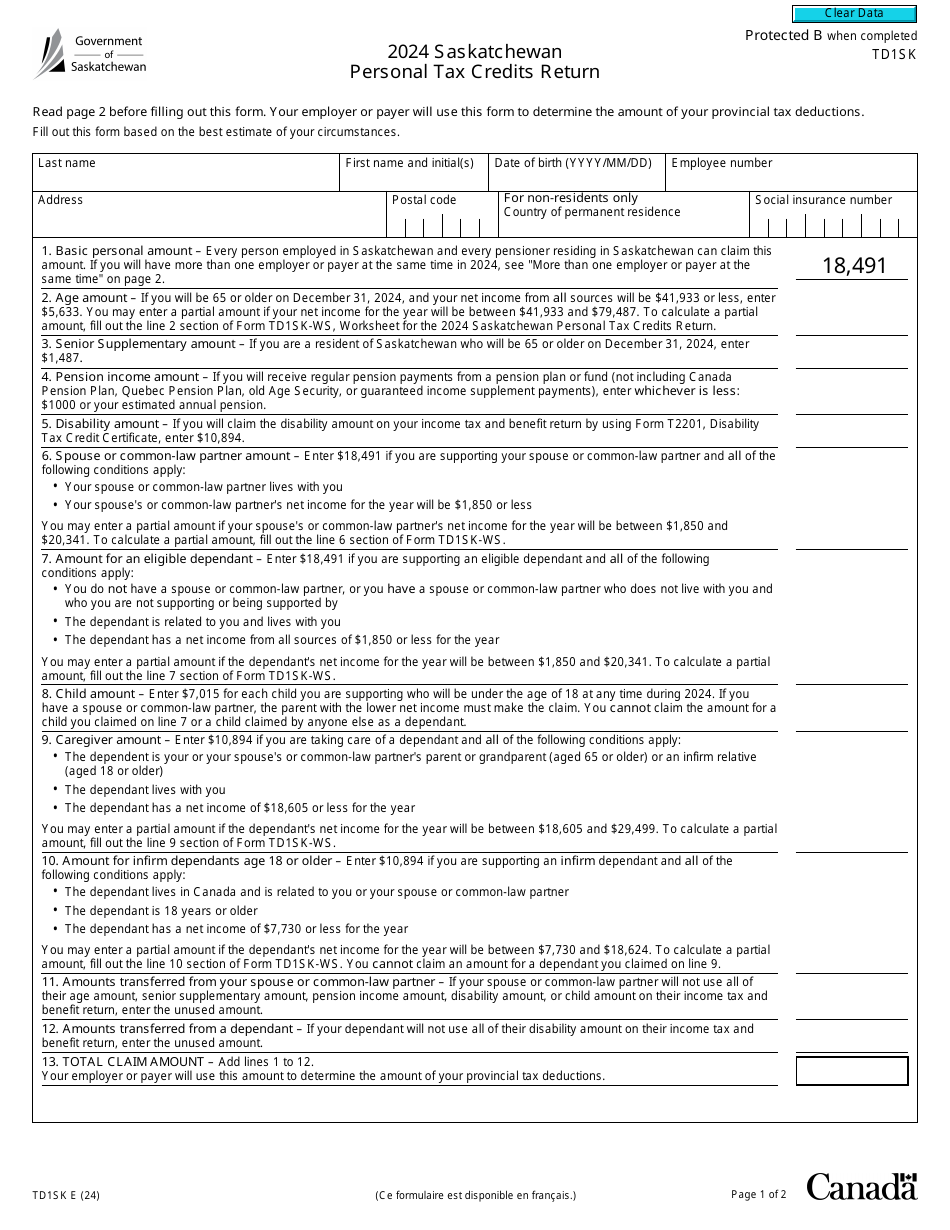

Tax Forms 2025 Saskatchewan 2025. Taxable income forms the basis for determining how much income tax an individual or a corporation owes to the saskatchewan government. What's new for january 1, 2025;

The federal and saskatchewan tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.047 (4.7% increase). The calculator reflects known rates as of june 1, 2025.

Saskatchewan 2025 Tax Forms Amanda Thomasine, Enter your details to estimate your salary after tax.

Fillable Form TD1 (2025) Edit, Sign & Download in PDF PDFRun, Enter your details to estimate your salary after tax.

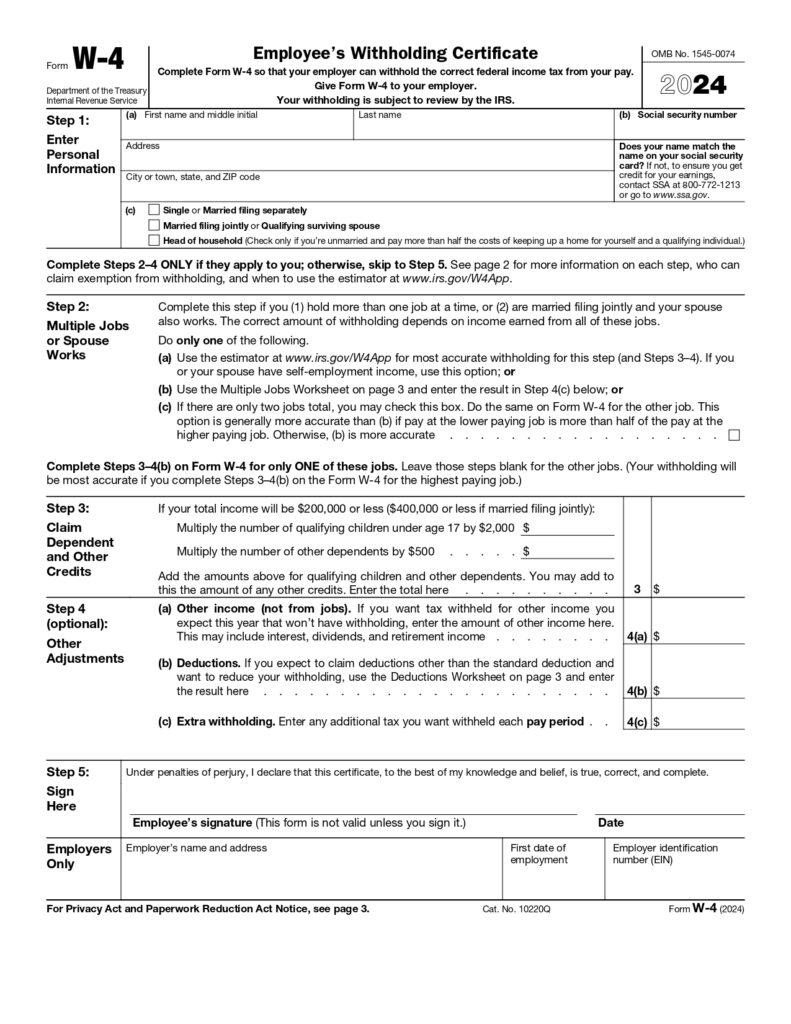

Irs W4 Tax Calculator 2025 Dell Moreen, The federal and saskatchewan tax brackets and personal tax credit amounts are increased for 2025 by an indexation factor of 1.047 (4.7% increase).

Irs Schedule A 2025 Seka Winona, Calculate some of the amounts to report on your saskatchewan tax and credits form.

Alberta Personal Tax Forms 2025 Merl Cathrine, Saskatchewan 2025 and 2025 tax rates & tax brackets.

Saskatchewan 2025 Tax Forms Amanda Thomasine, After you've completed inputting your information, you may examine your tax return and electronically submit it.

2025 Tax Insights Key Changes Every Dentist Needs to Know, It will also compute your taxes and show you how much of a refund you will receive or how much tax you will owe.

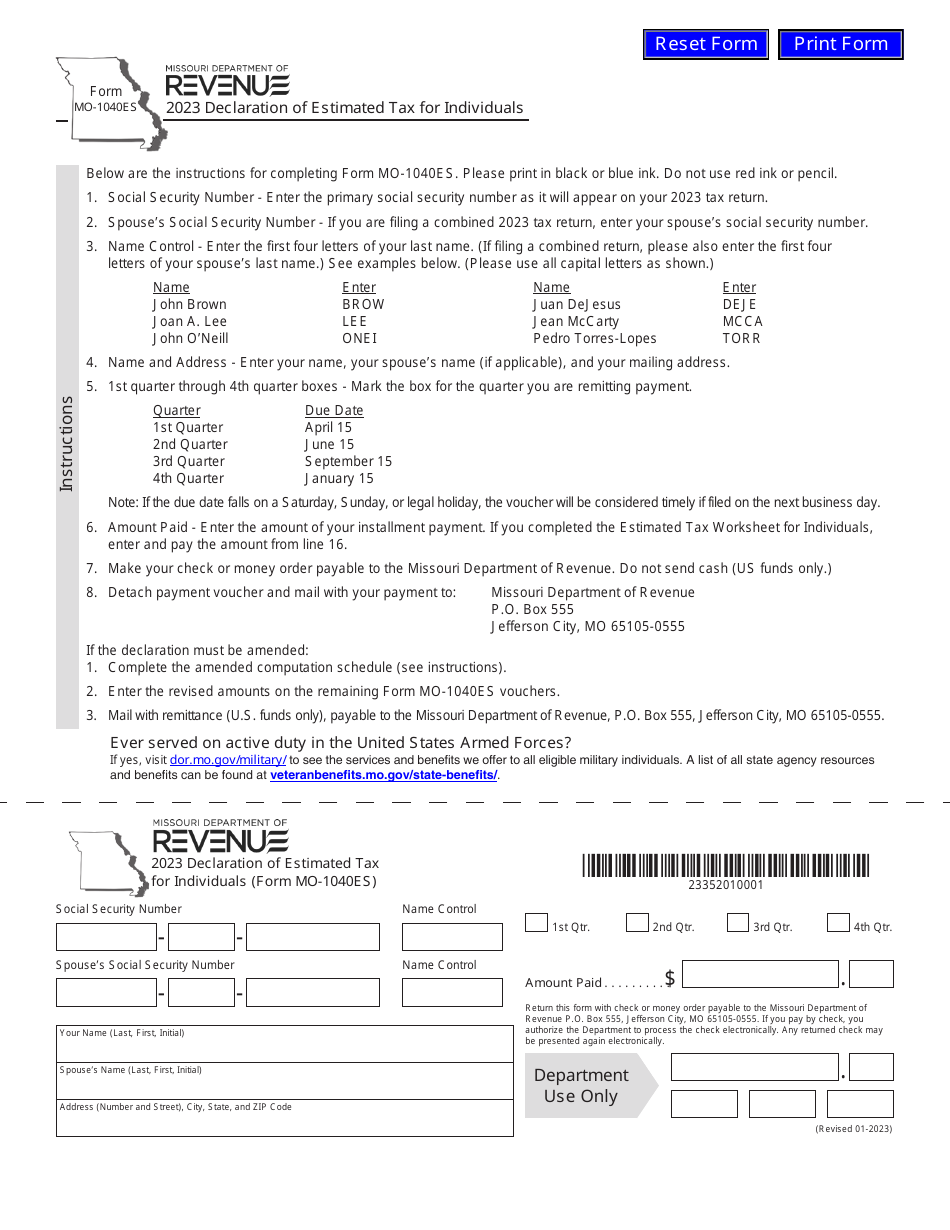

2025 Quarterly Tax Forms Trula Miguelita, The free online 2025 income tax calculator for saskatchewan.

The Decrypt 2025 U.S. Tax Guide Decrypt, This calculator, relevant to saskatchewan, comprises 3 steps to calculate the figure for line 428 of your tax return:

Federal Tax Forms 2025 Gayel Joelynn, Taxable income forms the basis for determining how much income tax an individual or a corporation owes to the saskatchewan government.